salt tax deduction explained

The state and local tax deduction SALT for short was the most significant tax break eliminated under the tax reform. 52 rows The SALT deduction allows you to deduct your payments for property.

Changes To The State And Local Tax Salt Deduction Explained

SALT refers to the state and local taxes associated with a federal income tax deduction for taxpayers that itemize their deductions.

. SALT stands for the state and local tax deduction that taxpayers can claim when they dont take a standard deduction and choose to itemize. Move from New York to Florida. The deduction went into effect during the 2019 tax year and included a cap of 10000.

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local. A 10000 ceiling on the previously. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for.

Blanca Ocasio-Cortez the mother of the new socialist superstar in Congress did what dozens of parents I know have done. It allows those in high-tax states to deduct the money they spend on local and state taxes. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. The value of the SALT deduction as a percentage of adjusted gross income AGI increases with a taxpayers income. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax.

Salt tax deduction explained Monday April 4 2022 Edit. In 2016 taxpayers with AGIs between 0 and 24999. There is talk that the SALT deduction limit will be.

What is the SALT deduction.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

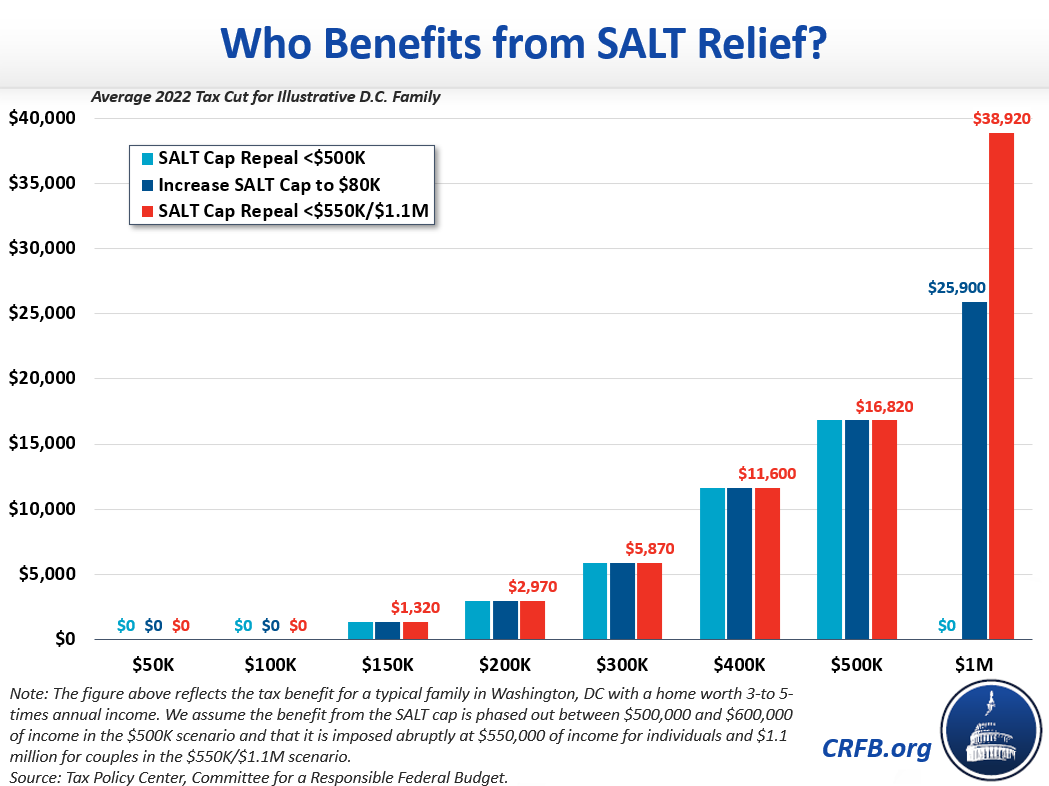

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Salt Deduction Resources Committee For A Responsible Federal Budget

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Salt Cap Repeal Salt Deduction And Who Benefits From It

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

What Is The Salt Deduction H R Block

Unlock State Local Tax Deductions With A Salt Cap Workaround

How Does The Deduction For State And Local Taxes Work Tax Policy Center

10 000 Tax Deduction For State And Local Tax Salt Deduction Itemized Deductions Schedule A Youtube

Irs Will Issue Regs On The Salt Tax Deduction Limit Wipfli

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)