charitable gift annuity example

You have sufficient income now but want to supplement your cash flow later for example when you retire. An Example of How It Works.

Nine Pbs Gift Annuity The Gift That Gives Back

Because they need continuing income they decide to give the cash in exchange.

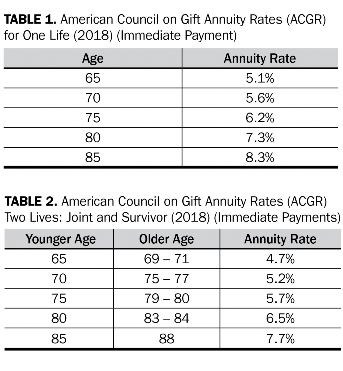

. Given her age and. State tax liability is not. Based on their ages they will receive a payment rate of 51 which means that.

Dennis 75 and Mary 73 want to make a contribution to NorthShore but they also want to ensure that they have dependable income during their retirement years. An alum is looking to secure her finances in retirement. Because they need continuing income they decide to give the cash in exchange.

Because they need continuing income they decide to give. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Dominican University. She has a nest egg of.

Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Feeding America. An Example of How It Works. A deferred charitable gift annuity could be right for you if.

Dennis 75 and Mary 73 want to make a contribution to NPF but they also want to ensure that they have dependable income during their retirement years. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. A graphic illustration of a charitable gift annuity is available.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Ann a 77-year-old woman who loves animals decides to cash in a maturing certificate of deposit. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to the National Park Foundation.

Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Temple University. Deferred Charitable Gift Annuity. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to the International Rescue Committee.

Sample Gift Annuity Disclosure StatementLetter. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to AARP Foundation. Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35.

Because they need continuing income they decide to give the cash in. 7 rows Susan would like to provide her mother Esther 80 with additional income but knows that her. Because they need continuing income they decide to give the cash in.

Charitable Gift Annuities An Example. As with any other. Charitable Gift Annuity An example of a CGA at Georgetown.

Charitable Gift Annuity. Because they need continuing income they decide to give the cash in. Because they need continuing income they decide to give the cash in exchange for.

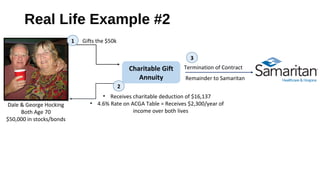

Our donor age 75 plans to donate a maturing 25000 certificate of deposit to The Greater Boston Food Bank. The Philanthropy Protection Act of 1995. She establishes a charitable gift annuity of 25000.

They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. Sample Gift Annuity Disclosure StatementLetter.

What Is A Charitable Gift Annuity And How Does It Work 2022

Planned Giving Calculator Harvard Alumni

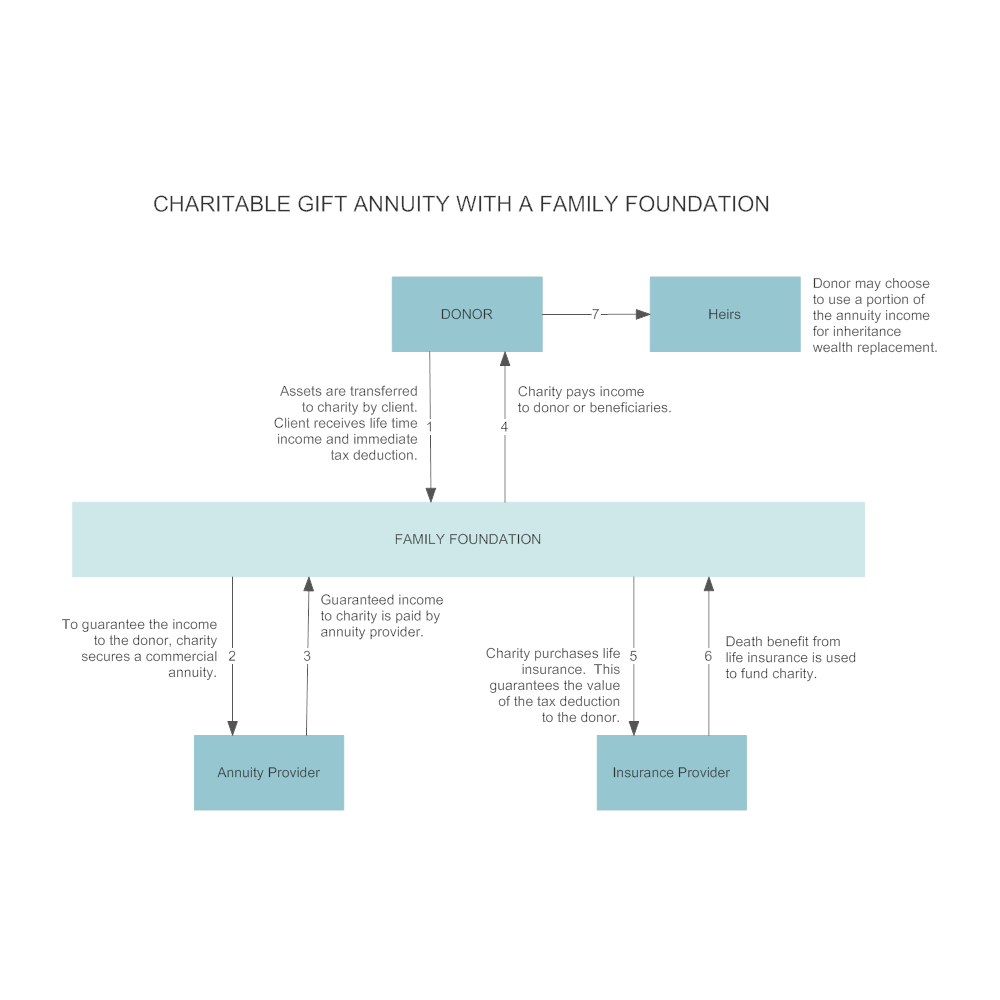

Charitable Gift Annuity With A Family Foundation

Charitable Gift Annuities The Guthrie Theater

Charitable Gift Annuities Barnard College

The Weird Math Of Charitable Gift Annuities Retirement Income Journal

What Is A Charitable Gift Annuity

Charitable Gift Annuities 1 Introduction Youtube

Introduction To Charitable Gift Annuities

Charitable Gift Annuities Studentreach

Charitable Gift Annuity Rate Increases Texas A M Foundation

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

Gift Calculator Planned Parenthood

Charitable Gift Annuity Giving To St Lawrence

Msu Extension Montana State University